Show

While browsing through New York City’s rental listings, you have likely come across an increasingly common term called “net effective rent.” The ad lists the apartment’s rent as $2,000, but the net effective rent is $1,833. It also mentions “1-month free” on a 12-month lease. So what is net effective rent, and how does it work?  What is net effective rent, anyways?The net effective rent is calculated by dividing the total gross rent of the lease by the number of months, including any discounts, offers, or promotions. It essentially indicates that a discount has been applied to the apartment on rent. Landlords offer rent concessions like a free month on the lease to attract tenants. But, do you pay the net effective rent every month for the duration of your lease? Probably not. Landlords grab your attention with the advertised net effective rent. But, you’ll most likely pay the “gross rent” or actual rent advertised, and the first or last month of your lease will be free. Gross Rent vs. Net Effective Rent: Know The DifferencesGross RentIn simple terms, gross rent is the flat rate you pay monthly for your apartment until the lease ends. It may include utilities, apartment amenities, or maintenance fees. Landlords use gross rent to verify your financial qualifications. For example, NYC has a 40x gross rent annual income requirement for tenants. So if an apartment has a gross rent of $2,000, the eligible tenant must have a yearly income of $80,000. Net Effective RentNet effective rent is the discounted rent that’s advertised on the rental listing. It’s usually lesser than the gross rent as the landlord provides one or more free months on the lease. A lower rent attracts tenants, but this could be misleading since tenants are asked to pay the gross rent most of the time. However, the first or last month (or more) goes free as per your lease agreement. Calculate Your Net Effective RentYou can calculate net effective rent by multiplying gross rent with lease length minus the free months discounted by your landlord. You divide this amount with the total length of the lease. Here’s a formula to make it easy!  Let’s assume your monthly gross rent to be $2,000. The landlord offers a 12-month lease, with one month discount. To figure the net effective rent, you multiply gross rent, i.e., $2,000, with the number of months you’ll pay the rent, i.e., 11. You then divide this number with the total length of your lease, which is 12 months. The net effective rent for 12 months will be $1,833. You Will Likely Still Pay Gross RentAs a tenant, net effective rent in a rental listing can be confusing yet beneficial. By getting one or more months free, you are saving money overall. However, unless there’s a particular clause in your lease mentioning net effective rent will be charged per month, your landlord will ask you to pay the gross rent. Always Read Your Lease Before SigningLandlords offering you discounts and concessions on rent can sound attractive. But always make sure to read the fine print! As a tenant, you must make sure that the net effective rent clause is added to the lease agreement. You wouldn’t want a last-minute unexpected rental payment! The landlord must honor the agreement and stick to the words in rental listings. If you feel your landlord violated the terms, you can approach a civil court and file a fraudulent lawsuit. Remember that net effective rent is a marketing tool, and the gross rent is what you’ll pay. If the landlord mentions discounts, it must be mentioned in your lease as well! How do you calculate net effective rent?Calculate Your Net Effective Rent

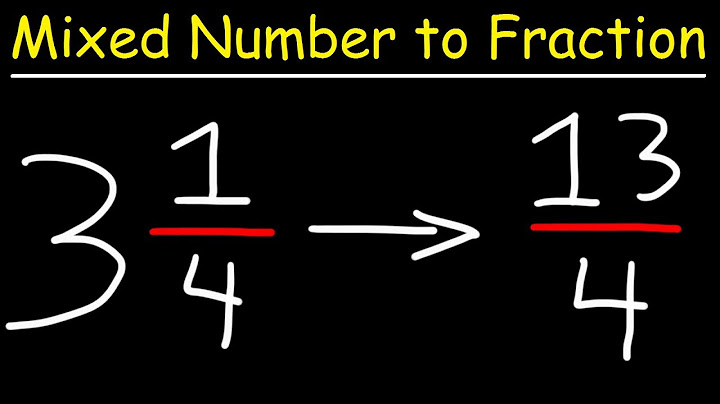

You can calculate net effective rent by multiplying gross rent with lease length minus the free months discounted by your landlord. You divide this amount with the total length of the lease.

What is ner in commercial real estate?When a commercial real estate landlord or broker calculates net effective rent (NER), they take the total amount of concessions, such as tenant improvements, divide it by the term of the lease and then deduct that amount from the monthly asking rent.

How do you calculate net effective rent with tenant improvements?For instance, if a tenant signed a 5 year lease for $20/sf per year, but received a $10/sf tenant improvement allowance and five months free rent, the effective rent would be $16.33/sf ($20 / 12 months = $1.67/month x 5 months free = $8.33 plus $10/sf tenant improvement allowance = $18.33/sf total cost to landlord.

|

Related Posts

Advertising

LATEST NEWS

Advertising

Populer

Advertising

About

Copyright © 2024 chuyencu Inc.