|

Understanding Social Security . . Understanding Social Security Between retirement accounts and Social Security payments, many retirees can receive enough monthly income to live comfortably. But it's important that you understand exactly how Social Security works. GOBankingRates features a wide selection of articles on this subject, so if you have any questions or concerns you can find the information you need.Read articles about Social Security facts you haven't considered, as well as advice on Show

Top 1: Social Security | GOBankingRates | GOBankingRatesAuthor: gobankingrates.com - 116 Rating

Description: Understanding Social Security Understanding Social Security Between retirement accounts and Social Security payments, many retirees can receive enough monthly income to live comfortably. But it's important that you understand exactly how Social Security works. GOBankingRates features a wide selection of articles on this subject, so if you have any questions or concerns you can find the information you need.Read articles about Social Security facts you haven't considered, as well as advice on

Matching search results: WebRead articles about Social Security facts you haven't considered, as well as advice on why you shouldn't rely solely on Social Security income. You’ll also find guides on how to collect Social Security payments, how to increase your Social Security benefits and the long-term financial concerns about retirement. ...

Top 2: How to Minimize Taxes in Retirement | The Motley FoolAuthor: fool.com - 91 Rating

Description: How to determine your tax bracket in retirement. Taxes on Social Security income. Taxes on IRA and 401(k) withdrawals. Taxes on investment income. Related Retirement Topics. Invest in Roth. accounts. Live in a tax-friendly state. Make strategic. withdrawals. Choose tax-free investments. Invest for the long term When you're a retiree, taxes can eat into your available income and leave you with less to live on. It's important to remember that taxes don't stop once you're retired, but you can take s

Matching search results: WebJun 28, 2022 · A portion of your Social Security benefits (in some situations) Some pension income; Income from work (either full time or part time) ... If you don't want to worry about paying taxes after you ... ...

Top 3: Payments | Internal Revenue Service - IRS tax formsAuthor: irs.gov - 79 Rating

Description: Pay Online EnglishEspañol中文 (简体)中文 (繁體)한국어РусскийTiếng ViệtKreyòl ayisyenWe accept full and partial payments, including payments toward a payment plan (including installment agreement). Penalties and interest will continue to grow until you pay the full balance.. Sign In to Pay and See Your Payment HistoryFor individuals only.View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your ba

Matching search results: WebOct 4, 2022 · Avoid a penalty by filing and paying your tax by the due date, even if you can’t pay what you owe. For individuals and businesses: Apply online for a payment plan (including installment agreement) to pay off your balance over time. ...

Top 4: Understanding Social Security Benefits | The Motley FoolAuthor: fool.com - 104 Rating

Description: How Social Security works. Related Retirement Topics. Brief history of Social Security. Eligible family members include: Social Security forms an important part of most people's retirement plans, but the program itself does much more than just that. In a nutshell, Social Security is designed to support disabled and retired workers and their families by providing a guaranteed source of lifetime income for those who meet certain criteria.Here's a closer look at how the program works,. the differen

Matching search results: WebDec 31, 2022 · Social Security is a government program that collects taxes from working Americans and distributes these funds to qualifying disabled workers, retirees, and their families to help them remain ... ...

Top 5: Taxes on Social Security income | FidelityAuthor: fidelity.com - 113 Rating

Description: Taxes on retirement income. 1. Converting savings into a Roth IRA. 2. Delaying your Social Security benefit claim. Next steps to consider Key takeawaysYou may end up paying taxes on your Social Security benefits, depending on your household income.One key to reducing your tax burden in retirement is to reduce your taxable income, and there are strategies available to do that.If you can delay receiving your Social Security benefits and qualify for a. partial Roth conversion, you may be able reduc

Matching search results: WebAug 15, 2022 · Taxes on Social Security: 2 ways to save Learn how you can help reduce your taxable income in retirement. Fidelity Viewpoints – 08/15/2022 1605 Key takeaways. You may end up paying taxes on your Social Security benefits, depending on your household income. One key to reducing your tax burden in retirement is to reduce your … ...

Top 6: International Programs - U.S. International Social Security …Author: ssa.gov - 121 Rating

Description: U.S. International Social Security Agreements. The Problem of Dual Coverage. The Problem of Gaps in Benefit Protection U.S. International Social Security AgreementsIntroductionSince the late 1970's, the United States has established a network of bilateral Social Security agreements that coordinate the U.S. Social Security program with the comparable programs of other countries. This article gives a brief overview of the agreements and should be of particular interest to multinational companies

Matching search results: WebWhen this happens, both countries generally require the employer and employee or self-employed person to pay Social Security taxes. Dual Social Security tax liability is a widespread problem for U.S. multinational companies and their employees because the U.S. Social Security program covers expatriate workers--those coming to the United States ... ...

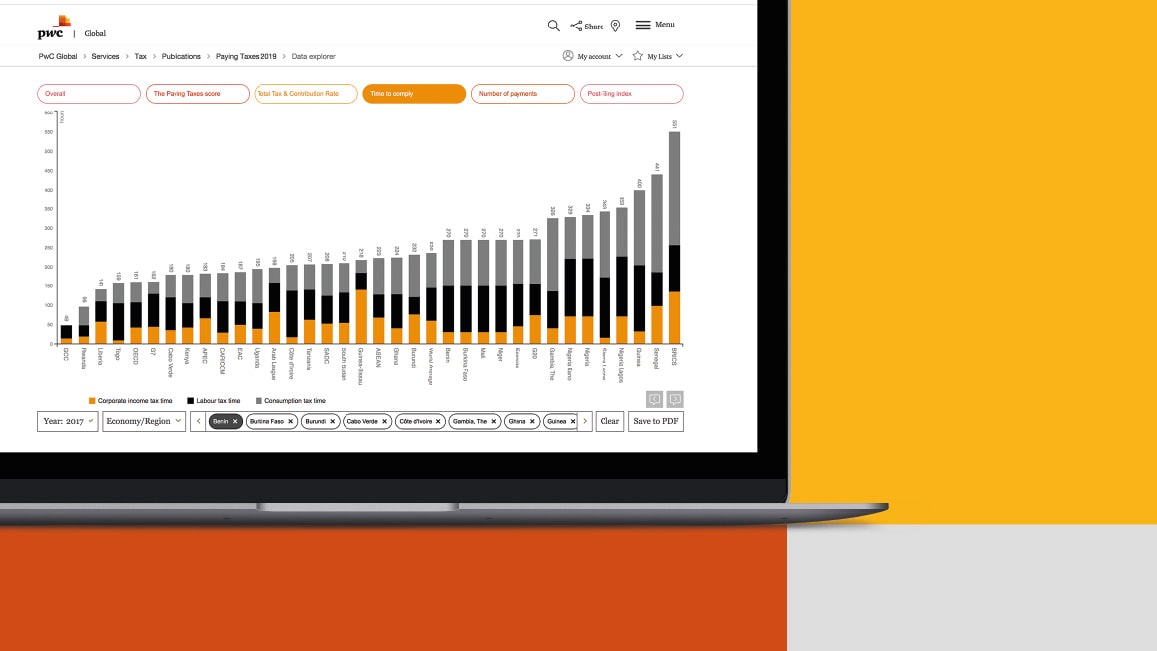

Top 7: Paying Taxes 2020: In-depth analysis on tax systems in 190 ... - PwCAuthor: pwc.com - 142 Rating

Description: Access the Paying Taxes interactive tools. Movements in the Paying Taxes indicators. What were the largest changes to the Paying Taxes indicator in 2018? What we can learn from tax regimes in 191 economies around the world PwC and the World Bank Group reveal the power of technological advances for taxpayers and tax administrations. Paying. Taxes, a study from PwC and the World Bank Group, was published annually from 2006 to 2019 using data from the World Bank Group's Doing Business

Matching search results: WebPaying Taxes, a study from PwC and the World Bank Group, was published annually from 2006 to 2019 using data from the World Bank Group's Doing Business Study.In September 2021, the World Bank announced that it has discontinued Doing Business and therefore the Paying Taxes data on this page is not current and will only be retained for reference, but … ...

Top 8: Who Is Exempt from Paying Social Security Tax? - TurboTaxAuthor: turbotax.intuit.com - 164 Rating

Description: File 100% FREE with expert help. Qualifying religious exemption. Temporary student exemption. Foreign government employees. TaxCaster Tax Calculator. Tax Bracket. Calculator. W-4 Withholding Calculator. Self-Employed Tax Calculator. Self-Employed Tax Deductions Calculator TopUpdated for Tax Year 2022 • December 1, 2022 09:15 AMOVERVIEWMost people can't avoid paying Social Security taxes on their employment and self-employment income. There are, however, exemptions available to specific groups of

Matching search results: WebDec 1, 2022 · Social Security tax. Just like the income tax, most people can’t avoid paying Social Security taxes on their employment and self-employment income. There are, however, exemptions available to specific groups of taxpayers. If you fall under one of these categories, you can potentially save a significant amount of money. ...

Top 9: When Do I Stop Paying Social Security Tax? - InvestopediaAuthor: investopedia.com - 164 Rating

Description: Basics of Social Security. Withholding . Who Doesn't Have to Pay Social Security? . Members of Some Religious Groups . Certain Foreign Visitors . Some American College Students . Pre-1984 Federal Employees . Certain State and Local Government Workers Of all the taxes that come out of your paycheck, none may be as inescapable as those that go to. Social Security. Whether you're salaried or self-employed, you must generally contribute throughout. your entire working life. There are,

Matching search results: WebNov 13, 2022 · Some workers are exempt from paying Social Security taxes if they, their employer, and the sect, order, or organization they belong to officially decline to accept Social Security benefits for ... ...

Top 10: Income Taxes And Your Social Security BenefitAuthor: ssa.gov - 103 Rating

Description: Some of you have to pay federal income taxes on your Social Security benefits. This usually happens only if you have other substantial income in addition to your benefits (such as wages, self-employment, interest, dividends and other taxable income that must be reported on your tax return).You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service (IRS) rules. If you:file. a federal tax return as an "individual" and your combined income* is between $25

Matching search results: between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. · more than $34,000, up to 85 percent of your benefits may be ...between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. · more than $34,000, up to 85 percent of your benefits may be ... ...

Top 11: How Are Social Security Benefits Taxed? - AARPAuthor: aarp.org - 132 Rating

Description: If your total income is more than $25,000 for an individual or $32,000 for a married couple filing jointly, you must pay federal income taxes on your Social Security benefits. Below those thresholds, your benefits are not taxed. That applies to spousal benefits,. survivor benefits and. Social Security Disability Insurance (SSDI) as well as to. retirement benefits.The portion of your benefits subject to taxation varies with income level. You’ll be taxed on:up to 50 percent of your benefits if your i

Matching search results: Say you file individually, have $50,000 in income and get $1,500 a month from Social Security. You would pay taxes on 85 percent of your $18,000 in annual ...Say you file individually, have $50,000 in income and get $1,500 a month from Social Security. You would pay taxes on 85 percent of your $18,000 in annual ... ...

Top 12: Is Social Security Taxable? - InvestopediaAuthor: investopedia.com - 148 Rating

Description: How Much of Your Social Security Income Is Taxable? . Social Security Benefits Tax Tool . Are Spousal, Survivor, Disability, and SSI Benefits Taxable? . Paying Taxes on Social Security . State Taxes on Social Security . 3 Ways to Avoid Taxes on Benefits . How Do I Determine If My Social Security Is Taxable?. What Percentage of Social Security Is Taxable?. Do I Have to Pay State Taxes on Social Security?. Does Social Security Income Count As Income?. At What Age Is Social Security No Longer Taxed?. Individual Tax Rates . Disability Benefits . Place Some Retirement Income in Roth Accounts . Withdraw Taxable Income Before Retirement . Purchase an Annuity .

Matching search results: If you file as an individual, your Social Security is not taxable if your total income for the year is below $25,000. Half of it is taxable if your income is in ...Taxable Portion of Social... · Paying Taxes on Social SecurityIf you file as an individual, your Social Security is not taxable if your total income for the year is below $25,000. Half of it is taxable if your income is in ...Taxable Portion of Social... · Paying Taxes on Social Security ...

Top 13: How taxes can affect your Social Security benefits - VanguardAuthor: investor.vanguard.com - 155 Rating

Description: Will you owe taxes on your Social Security benefits?. States that tax your Social Security income. What's the provisional income formula?. Social Security income limits. Create a tax-efficient Social Security strategy. Consider these. strategies Points to knowRetirees with moderate or higher incomes likely will pay federal taxes on some portion of their benefits.Thirteen states also impose a state income tax on Social Security benefits.Carefully consider the possibility of taxation of your Socia

Matching search results: Generally, if Social Security is your only retirement income, you won't have to pay taxes on it. But if you have at least moderate income, you'll most likely ...Single; head of household; qualifying widow/widower; married, filing separately (spouses lived apart for all of the tax year): $0 to ...Married, filing jointly: $0 to $32,000; >$32,000; >$44,000FILING STATUS: PROVISIONAL INCOME THRESHOLDGenerally, if Social Security is your only retirement income, you won't have to pay taxes on it. But if you have at least moderate income, you'll most likely ...Single; head of household; qualifying widow/widower; married, filing separately (spouses lived apart for all of the tax year): $0 to ...Married, filing jointly: $0 to $32,000; >$32,000; >$44,000FILING STATUS: PROVISIONAL INCOME THRESHOLD ...

Top 14: Regular & Disability Benefits | Internal Revenue ServiceAuthor: irs.gov - 159 Rating

Description: AnswerSocial security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income (SSI) payments, which aren't taxable. The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099, Social Security Benefit Statement, and you report that amount on line 6a of. Form 1040, U.S. Individual Income Tax Return or Form 1040-SR,. U.S. Tax Return for Seniors. The taxabl

Matching search results: I retired last year and started receiving social security payments. Do I have to pay taxes on my social security benefits? ... Social security benefits include ...I retired last year and started receiving social security payments. Do I have to pay taxes on my social security benefits? ... Social security benefits include ... ...

Top 15: Social Security Income | Internal Revenue ServiceAuthor: irs.gov - 96 Rating

Description: Top Frequently Asked Questions for Social Security Income. Frequently Asked Question Subcategories for Social Security Income. I retired last year and started receiving social security payments. Do I have to pay taxes on my social security. benefits? . Are social security survivor benefits for children considered taxable income? I received social security benefits this year that were back benefits for prior years. Do I amend my returns for those prior years? Are the back benefits paid in this year for past years taxable this year? .

Matching search results: Sep 7, 2022 · I retired last year and started receiving social security payments. Do I have to pay taxes on my social security benefits?Sep 7, 2022 · I retired last year and started receiving social security payments. Do I have to pay taxes on my social security benefits? ...

Top 16: What 8.7% Social Security COLA for 2023 means for taxes on benefitsAuthor: cnbc.com - 181 Rating

Description: More from Year-End. Planning. How Social Security benefits are taxed. How beneficiaries' taxes may. increase in 2023. What to do to minimize your tax bite Halfpoint | Istock | Getty ImagesRetirees who rely on Social Security benefits for income will get some relief from record high inflation when an. 8.7% cost-of-living adjustment kicks in next year.But two factors — the size of Medicare Part B premiums and. taxes on benefits — may offset just how much bigger those monthly checks will be in 2023.Th

Matching search results: Oct 20, 2022 · Individuals with between $25,000 and $34,000 in combined income pay tax on up to 50% of their benefits. The same goes for married couples ...Oct 20, 2022 · Individuals with between $25,000 and $34,000 in combined income pay tax on up to 50% of their benefits. The same goes for married couples ... ...

|

Related Posts

Advertising

LATEST NEWS

Advertising

Populer

Advertising

About

Copyright © 2024 chuyencu Inc.